Inherited ira calculator

Inherited IRA Tax Strategies. If the surviving spouse wishes to treat the IRA as their own after.

![]()

Rmd Calculator Dialog 6 Successor Beneficiaries

One inherited IRA tax management tip is to avoid immediately withdrawing a single lump sum from the IRA.

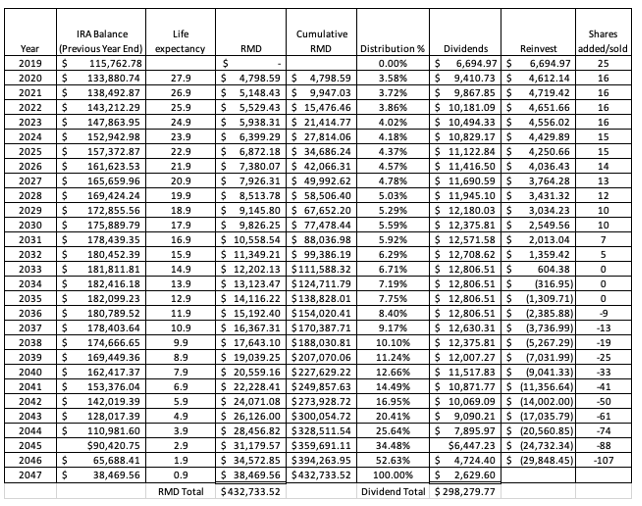

. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD. If you consolidate the money into your IRA then the regular RMD rules apply. The Inherited IRA RMD Calculators results may vary with each use and may change over time due to updates to the Calculator or because of changes in personal circumstances or market conditions.

For example check out our free retirement calculator and get started today. Consider returning to the Calculator at least annually to. For more information visit our rollover page or call Merrill at 8886373343 Footnote.

IRS rules limit you to one rollover per client per twelve month period. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. You can spread your distributions over time but the account must be fully distributed by Dec.

Calculate the required minimum distribution from an inherited IRA. What Is an Inherited IRA. In the past inherited IRAseven Roth accountscame with RMDs.

Move the money into your own IRA. Rollovers occur when you withdraw assets from an IRA and then roll those assets back into the same IRA or into another one within 60 days. If youve got one already or plan to open one soon use our Roth IRA calculator to see.

You can also review additional information in our Inherited IRA Brochure SECURE Act compliant. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. You transfer the assets into an inherited IRA in your name.

Inherited IRA RMD Calculator. The RMD rules are different for each choice so consider your options carefully. Consider all your choices.

Savers can choose either a Roth IRA or a traditional IRA for their rollover. An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death. An inherited IRA is an individual retirement account IRA you open when youre the beneficiary of a deceased persons retirement plan.

No RMDs for most beneficiaries. The Inherited IRA Distribution Calculators results may vary with each use and may change over time due to updates to the Calculator or because of changes in personal circumstances or market conditions. These rules dont apply if youve simply transferred another IRA to your own IRA but are specific to Inherited IRAs.

Contributions are rolled over from a workplace retirement plan such as a 401k or 403b. Use our Inherited IRA calculator to find out if when and how much you. This guidance is also for situations where the IRA account holder died after 2019 and therefore the rules under the SECURE Act apply.

Instead wait until RMDs are due or if you got the IRA from a non-spouse stretch withdrawals over 10 years. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. Over his or her.

How much are you required to withdraw from your inherited retirement accounts. Consider returning to the Calculator at least annually to. That can mean a potentially hefty tax bill for heirs forced to empty an inherited IRA within 10 years no matter whether they do it as one lump sum or in smaller bites.

With a traditional IRA withdrawals are taxed at your regular income rate. Roth individual retirement accounts IRAs are powerful tools for building tax-free savings in retirement. The spouse must make the election by the later of 1 December 31st of the calendar year in which they attain age 72 or 2 December 31st of the year following the calendar year of the IRA owners death.

Inherited IRAs are specifically designed for retirement plan beneficiariesthose who have inherited an IRA or workplace savings plan such as a 401k. If you inherit the IRA from your spouse there are two ways to take control of the account. RMD amounts depend on various factors such as the.

Investing involves risk including risk of loss. If you simply want to withdraw all of your inherited money right now and pay taxes you can. Benefits of an Inherited IRA.

Tax rules for beneficiaries are different depending on whether you are a spouse or non-spouse. Open an inherited IRA. For an inherited IRA received from a decedent who passed away before January 1 2020.

Inherited IRA beneficiary tool. When a beneficiary becomes entitled to an IRA from an account owner who died before he or she was required to begin taking RMDs April 1st of the year following the year in which the owner reached RMD age the beneficiary can choose one of two methods of distribution. Most types of IRAs or workplace retirement plans can be transferred to an inherited IRA including traditional Roth.

If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA. Inherited IRA RMD Calculator. RMD Rules for Inherited IRAs.

An inherited IRA is an individual retirement account that gets opened for a beneficiary this could be a spouse family member unrelated person trust estate or non-profit organization after the original owner dies.

Top 5 Best Ira Calculators 2017 Ranking Calculate Tax Rmd Withdrawal Distribution Sep Beneficiary Advisoryhq

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

The Inherited Ira Portfolio Seeking Alpha

Inherited Ira Papers Next To A Calculator And Notepad Stock Image Image Of Payment Finance 253287511

![]()

Rmd Calculator Dialog 6 Successor Beneficiaries

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

What Is An Inherited Ira Learn More Investment U

The Ird Deduction Inherited Ira Beneficiaries Often Miss

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

The Inherited Ira Portfolio Seeking Alpha

New Rules For Inherited Iras What Is The New 10 Year Rule Marca

Can An Inherited Ira Be Rolled Over Smartasset

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Irs Wants To Change The Inherited Ira Distribution Rules

Ira Withdrawal Calculator Cheap Sale 52 Off Www Al Anon Be